Digital inclusive insurance solutions - Zambia

Practitioner seminar

18-19 May 2021 - Digital edition

properties.trackTitle

properties.trackSubtitle

Digital solutions for inclusive insurance have contributed to making insurance accessible to the underserved and unserved market segments and households. The emergence of InsurTechs and increased participation of Mobile Network Operators in insurance value chains serves as evidence of the importance of digital solutions in inclusive insurance distribution. This practitioner seminar discussed trends, models, strategies and lessons learnt in establishing digital inclusive insurance products in Zambia.

The key role that financial inclusion plays in economic development has been acknowledged by the government of Zambia for many years. The National Financial Inclusion Strategy (NFIS) 2017–2022 was developed to accelerate progress towards an inclusive, stable and competitive financial sector. In addition, the Bank of Zambia has incorporated financial inclusion as the second pillar in its 2020–2023 strategic plan for contributing to achieving the targets of the NFIS. Established in 2009, the Technical Advisory Group (TAG), which is now a registered microinsurance association, has been the main driver for inclusive insurance. The TAG association plays critical roles such as sector coordination, market facilitation and advocacy on all issues relating to the extension of microinsurance services for all market segments – regardless of income levels or geographical location (see figure 1).

"Regardless of an individual’s income level, no one is exempted from the risks and shocks that often come with huge losses and financial demands. Inclusive insurance products provide an opportunity for people in low-income markets to have access to affordable and appropriate insurance products.”

Dynamic distribution models, especially unconventional channels, are at the core of inclusive insurance business models. Technology has proven to be an enabler of access to insurance – particularly in premium collection, claims administration and claims payouts.”

Even moreso after the pandemic, digitalisation will be the way forward and support market development. Evidently, digital solutions have the potential to contribute to scale and improve efficiency in the insurance value chain – especially in client enrolment, premium collection, claims administration and claims payout. The partnership with MTN Zambia, AYO Zambia and Metropolitan Insurance now extend life, personal accident and hospital cash insurance covers to over one million people in Zambia. Digital solutions are likely to play an even bigger role in Zambia in the future.

Challenges for growth in Zambia

According to Cenfri, digital insurance solutions still account for less than 1% of the digital financial services (DFS) value and 0.3% of the DFS volume in Zambia. At the same time, over two thirds of the Zambian population do have an active DFS account.

One of the challenges limiting growth mentioned during the discussions was poor infrastructure, e.g. less than 30% Internet penetration in the country and electricity not being available for everyone. Reliance on physical distribution is still high and a lack of digital skills and financial literacy also remains a key barrier. At the same time, life and health insurance companies seem to be more interested in digital solutions, whereas general insurance companies show less interest. It is, however, interesting that four general insurance companies are now active in agricultural insurance for smallholder farmers. Although regulatory barriers are frequently being discussed in the context of barriers for the growth of digital solutions, that did not seem to be a key issue in the Zambian market. Nevertheless, an enabling regulatory environment remains key for successful growth. The introduction of the new Insurance Act of 2021 is good news for Zambia, as it contains progressive clauses and once operationalised will enhance the development of the country’s insurance industry. Some of the progressive clauses in the Act include the regulation and supervision of microinsurance. The new Insurance Act officially opens up the distribution space, which will support investments in digital solutions for inclusive insurance.

The challenge of making digital insurance tangible

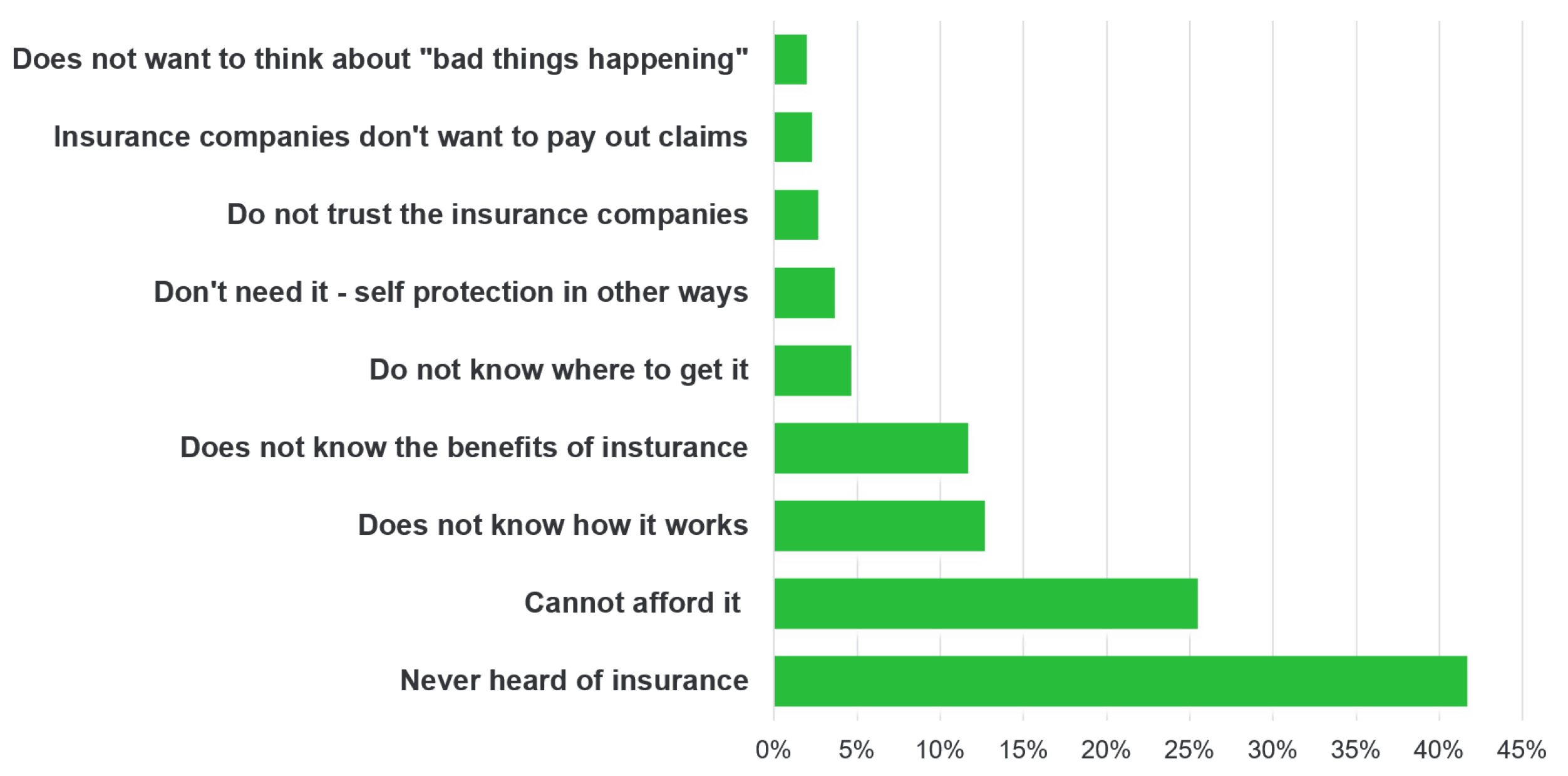

“Technology is an enabler but not a silver bullet” was a comment made by a representative from PIA. Experience presented from insurance providers and FinTechs underlined, for example, the importance of establishing partnerships with aligned interests. Partnerships between insurance companies and mobile network operators (MNOs) can increase outreach by leveraging trusted brands of MNOs. However, lack of interaction with customers,lack of understanding of insurance and more importantly how digital inclusive insurance solutions work can result in low renewal rates. Hence, panellists from all stakeholder groups agreed on the prioritisation of a customer-centric approach for the product design processes and distribution of digital inclusive insurance solutions. The recent FinScope survey results show that lack of understanding of insurance is a key barrier to uptake and usage of insurance services.

How insurance can successfully be distributed by embedding the risk management component into other services and hence make it more “tangible” was shown by examples from health and agriculture. BIMA combines health insurance with access to online doctor consultations. DigiFarm, a subsidiary of Safaricom, combines buying farm inputs and making online payments with access to insurance. The platform currently has over 1.4 million farmers registered, of which around 65,000 bought insurance. ACRE Africa today has over 1.7 million smallholder farmers insured in East Africa.

The way forward

Overall, experts agreed that the future looks very promising for digital insurance solutions. The seminar revealed that insurers are willing to adopt digital models to increase the outreach of inclusive insurance. The practitioners openly shared some of the failures, challenges and lessons learnt from some of the models such as loyalty and freemium. It was interesting to note that new innovative approaches have demonstrated promising results. Stakeholders are willing to partner if they do see value. Aligning interests and goals remain a key success factor for effective partnerships. Some speakers noted that the TAG should include MNOs, FinTechs and distribution channels in the list of stakeholders they are working with. Following the introduction of the new Insurance Act, it was also noted that the insurance regulator (PIA) and the TAG association are committed to developing comprehensive regulations that will include provisions from digital inclusive insurance solutions.

Client centricity remains important. Insurance still needs to be explained and digitalisation cannot entirely replace direct interactions with clients. Customers are willing to use simple and seamless digital insurance solutions, but infrastructure such as access to the Internet and electricity remains an issue. Nevertheless, although it will probably take more time than is commonly expected, there seem to be a lot of gains for insurance providers as well as customers from digitalisation.

………………………………………………………………………………………………….

About the event

This digital practitioner seminar was co-hosted by the TAG Microinsurance Association and FinProbity Solutions with support from the Microinsurance Network, Financial Sector Deepening Zambia (FSD Zambia) and the Munich Re Foundation.

15 June 2021 - Dirk Reinhard, Lemmy Manje